Owing to the nature of the work and the proliferation of high-speed broadband, many jobs in the tech and IT industry are free from the physical constraints that apply to other fields. This means that tech professionals can be found almost anywhere in the world.

That said, some areas in the U.S. are better suited than others to those who want to work in the tech industry or who have a tech-related skill set. And the beauty of these ever-evolving tech-related times means that significant career opportunities exist in a variety of areas across the country. Aspiring tech professionals now have the chance to pursue their trade in a setting that suits their personal needs and lifestyle preferences.

So where are the 30 best tech cities to call home? We analyzed multiple data sources to determine which cities would make the list. We considered factors such as:

- Number of tech jobs available and median earnings

- Level of venture capital investment

- The commute situation

- Cost of living

- After-work entertainment options

- Tech education resources

(For more information about our ranking system, check out the methodology we used to build our rankings right here.)

The 30 Best Cities for Tech

The 30 Best Cities for Tech

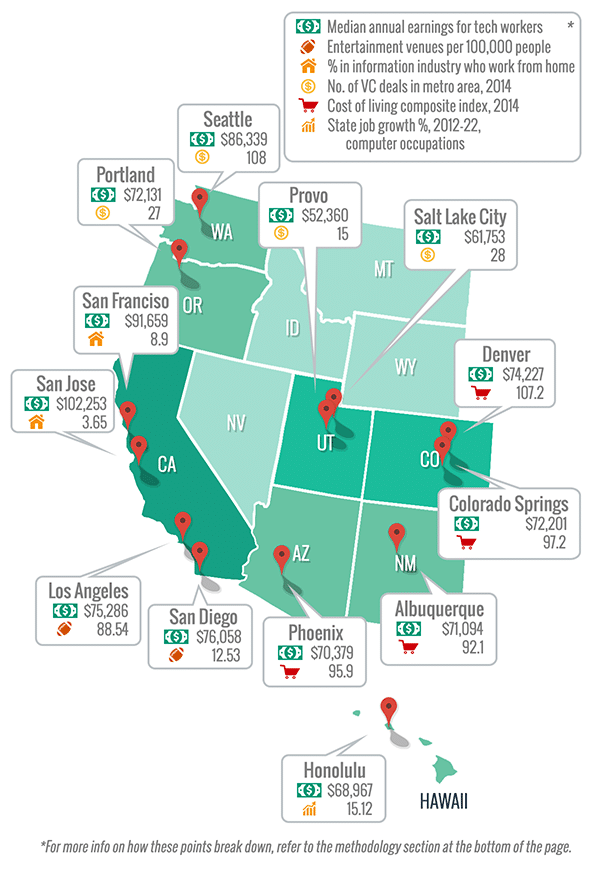

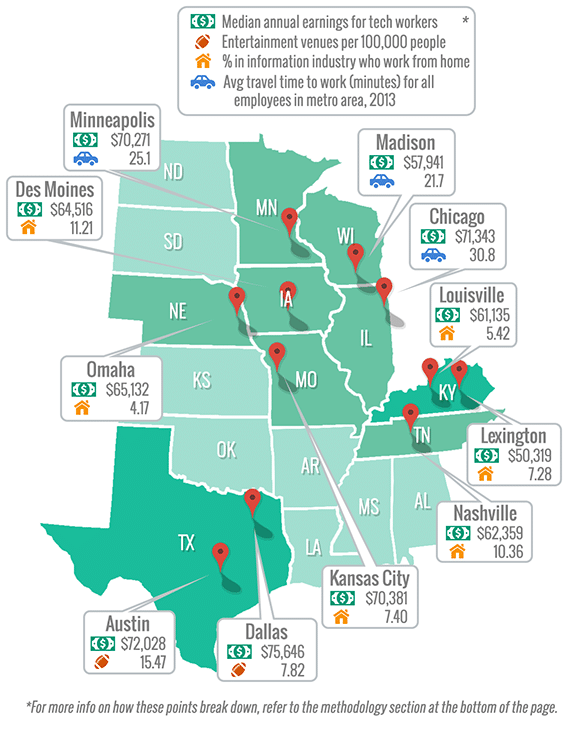

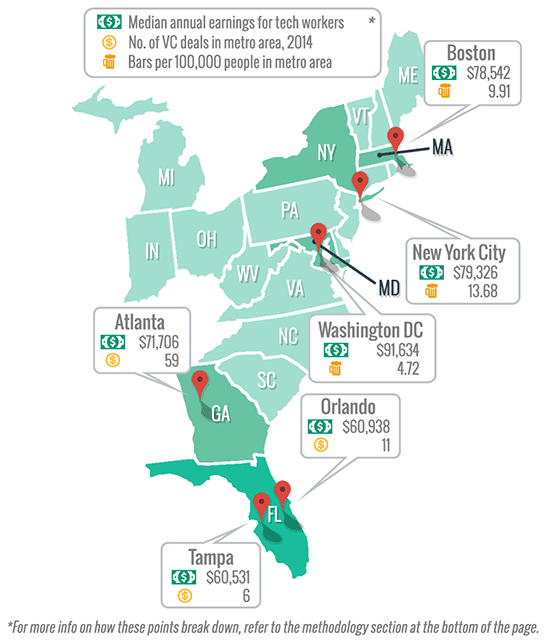

Here are our study results, with additional highlights and key data presented for the top 15. Additionally, we’ve provided a map depicting the locations and data on each of the cities that made our rankings. Depending on your perspective, you may be in for a surprise.

West

Central

East

#1 San Francisco

The San Francisco metropolitan area, comprised of San Francisco and the Peninsula to its south, backed by an astounding $15.7 billion of venture capital investment in 2014, has pulled Silicon Valley northward. “The City” has captured the limelight and become the No. 1 place to be for tech professionals. Additionally, while major companies like Twitter, Yelp and Salesforce.com make their home in San Francisco proper, the extent of this tech hub expands past the border of the city itself, including much of the Peninsula and the neighboring Silicon Valley.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $91,659

- Colleges and universities per 100,000 people: 2.08

- Entertainment venues per 100,000 people: 17.10

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 40.12%

#2 Denver

The capital of Colorado comes in at No. 2 with its consistently above-average scores in almost all criteria, as well as one of the highest percentages of state job growth for computer occupations in 2012. The city also offers “Denver startup week,” a free, annual, week-long symposium that offers several tracks including ones for founders, developers and inventors. While Denver has many successful startups such as Rally Software and Ping Identity (as well as many successful breweries), there’s still plenty of room for big dreamers.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $74,227

- Colleges and universities per 100,000 people: 2.00

- Entertainment venues per 100,000 people: 15.11

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 12.99%

#3 Washington, D.C.

The nation’s capital ranks third due to its high median annual income (just shy of San Francisco’s), and venture capital investments in the top 10 percent. Washington has been billed as an alternative to Silicon Valley by The Washington Post and The Next Web. But this tech region’s work culture is in stark contrast to the first and second on our list: it sets aside frills like Zumba class and nap-pods for a more stable work force and more tangible performance and behavior.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $91,634

- Colleges and Universities per 100,000 people: 2.11

- Entertainment venues per 100,000 people: 11.34

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 27.12%

#4 Des Moines

Des Moines boasts the lowest average commute time on the list and is among the top 10 percent for bars per capita. The abundance of cheap lands combined with enticing tax incentives make Iowa an ideal location for large data farms. With the popularity of smaller data farms on the rise, there should be plenty of room for growth.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $64,516

- Colleges and universities per 100,000 people: 2.38

- Entertainment venues per 100,000 people: 13.23

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 5.69%

#5 Salt Lake City

Utah actually has two cities in the top half of our list, with the state capital coming in at No. 5. Salt Lake City benefits from low unemployment and cost of living, as well as having the second-highest state job growth percentage. The latter is helped along by the state’s branding campaign, Silicon Slopes, which also emphasizes its world-class winter recreation.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $61,753

- Colleges and universities per 100,000 people: 1.60

- Entertainment venues per 100,000 people: 12.54

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 19.37%

#6 Austin

Austin boasts an exceptionally low unemployment rate, hovering just above 3 percent. There has also been considerable recent job growth in Texas, and Austin ranks in our top 10 percent for venture capital deals. With this in mind it’s easy to see Austin as an open playing field just waiting for more tech talent to come.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $72,028

- Colleges and universities per 100,000: 1.31

- Entertainment venues per 100,000 people: 15.47

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 11.38%

#7 San Jose

The self-proclaimed “Capital of Silicon Valley” comes in six places below its northern neighbor, San Francisco. That’s primarily because of the enormous difference in venture capital activity. That’s not to say money isn’t being invested in San Jose, as $6.9 billion in venture capital was invested in 2014 — the second-highest amount on our list. Additionally, the San Jose area features the list’s highest median annual earnings.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $102,253

- Colleges and universities per 100,000 people: 1.69

- Entertainment venues per 100,000 people: 8.27

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 22.14%

#8 Colorado Springs

If you’ve seen the movie “WarGames,” you’re probably familiar with Colorado Spring’s most famous feature — NORAD. The city is also home to Fort Carson and two Air Force bases, and that military tradition continues with the US Air Force Academy. Silicon Valley saw its beginning in the defense industry, and with its share of the state’s outstanding tech job growth, Colorado Springs might not be too far behind.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $72,201

- Colleges and universities per 100,000 people: 2.09

- Entertainment venues per 100,000 people: 16.29

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 9.52%

#9 Seattle

With the number of tech workers using alternative means of getting themselves to work — carpool, public transit, cycling, etc. — and average salaries both in the top 10 percent, Seattle looks good for tech work. On top of that, it also has one of the highest per capita restaurant counts. The city even has walking tours devoted to its food culture, and urban wineries.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $86,339

- Colleges and universities per 100,000 people: 1.41

- Entertainment venues per 100,000 people: 13.42

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 31.21%

#10 San Diego

San Diego offers tech workers generous median annual earnings, and many consider the high cost of living to be offset by the gorgeous sunny weather and plenty of beaches. If beaches aren’t what you’re after, it also offers up the largest amount of academic institutions per capita on our list by far.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $76,058

- Colleges and universities per 100,000 people: 4.08

- Entertainment venues per 100,000 people: 12.53

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 13.26%

#11 Boston

Boston’s tech industry got started back in the 1960s in the suburbs along Route 128. Boston’s biggest feature are its world-renowned schools, including MIT and Harvard, which power a local industry that’s attracted venture capital investments to the tune of more than $4.4 billion last year.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $78,542

- Colleges and universities per 100,000 people: 1.61

- Entertainment venues per 100,000 people: 11.59

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 28.29%

#12 Portland

Portland’s tech industry, later nicknamed the Silicon Forest, was founded in the 1940s on the shoulders of two companies: Electro Scientific Industries and Tektronix. Later, with the help of Intel, the area became populated by numerous spinoffs and startups, creating a complex corporate genealogy.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $72,131

- Colleges and universities per 100,000 people: 1.75

- Entertainment venues per 100,000 people: 15.64

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 20.93%

#13 Provo

Provo, Salt Lake’s neighbor, has commute times in the lowest 10 percent. Additionally, the area is at the forefront of state’s technology industry with Utah’s top 10 percent tech job growth.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $52,360

- Colleges and universities per 100,000 people: 0.55

- Entertainment venues per 100,000 people: 15.82

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 22.58%

#14 Nashville

With one of the lowest cost of living and highest per capita entertainment scores among our sample, Nashville came in at No. 14 in our ranking. While identified as a high-growth area for health care according to Forbes, the technology industry has seen growth in recent years as well.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $62,359

- Colleges and universities per 100,000 people: 1.68

- Entertainment venues per 100,000 people: 46.55

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 11.00%

#15 Minneapolis

While there’s been a recent decline in the supercomputing companies that were once at the forefront of the local industry in Minneapolis, their departure has been followed up with a large influx of small tech companies that fit in, rather than take over.

![]() Category Scores

Category Scores

- Median annual earnings for tech workers: $70,271

- Colleges and universities per 100,000 people: 2.07

- Entertainment venues per 100,000 people: 16.94

- Percent of tech workers who carpool, take public transit, bicycle or walk to work: 17.43%

#16 Phoenix

Phoenix’s tech industry is supported by Arizona State University and numerous tech and telecom companies that have recently relocated to the area. The climate offers warm winters and works well for the popular golfing industry.

#17 Omaha

Omaha is home to a large Internet junction, originally developed to support Strategic Air Command during the cold war. The industry focuses on support technology such as data processing.

#18 Lexington

Lexington is home to Lexmark and hosts branches of tenured industry leaders IBM, Xerox and HP.

#19 Los Angeles

LA is famous as a source of trophy homes for billionaire techies, like the $70 million mansion recently built for Minecraft creator Markus Persson. The industry is growing quickly and doesn’t have too far to climb to become a big player in terms of opportunities for new tech grads.

#20 Atlanta

As the nation’s ninth-largest city, Atlanta definitely has plenty of potential to grow an already-prominent local tech industry, being home to companies like Sila Nanotechnologies, Inc. and Cloud Sherpas, which was identified as the fastest-growing company in Atlanta according to Atlanta Business Chronicle in 2014.

#21 New York

With continued momentum in New York’s tech boom, Manhattan’s Silicon Alley continues to be a notable hub for aspiring tech professionals.

#22 Honolulu

Honolulu’s reputation for tourism may have shrouded its solid tech industry, but along with beautiful landscapes and weather, there are several local resources for tech companies including the Hawaii Venture Capital Association and the Honolulu-based High Technology Development Corporation.

#23 Albuquerque

Albuquerque has a sizable population of scientists and engineers due to research centers like Sandia National Laboratories, and when combined with low utility and business costs, this makes for a fertile environment for innovative companies.

#24 Kansas City

Kansas City is home to the incubator Think Big Partners, which formed a partnership with Microsoft Ventures, and was the first incubator established to do so.

#25 Tampa

The Tampa Bay area has major employers in computer and electronics components production and distribution.

#26 Dallas

Dallas is home to AT&T and Texas Instruments. Raytheon and Verizon join them to make up the four largest high-tech employers in the region. Additionally, Texas keeps its business regulation very limited and lacks a personal income tax.

#27 Orlando

Well known for its theme parks, Orlando is typically thought of as a tourist destination, but it is also home to a busy digital media industry.

#28 Chicago

At its core, Chicago’s tech industry has a conservative business model. That said, due to the city’s well-established and diverse economy, employment opportunities exist for tech professionals across various industries.

#29 Madison

Legislation is playing a big role in the establishment of tech in Madison, with attractive incentives for investments.

#30 Louisville

Louisville is involved in TechHire, the White House’s program to train workers for high-paying tech jobs.

Methodology

For this analysis, we ranked 78 U.S. cities that either had a city population above 300,000 or belonged to a metro area with a population above 500,000, based on 2013 population estimates from the U.S. Census. We ranked each city on a 10-point scale, using the data points listed below and the weighted values specified:

- Workers in the information industry (10%): The percentage of the working population in each city’s Metropolitan Statistical Area (MSA) employed in economic sector Information (code 51), which includes the Internet & technology, according to the North American Industry Classification System (NAICS) (County Business Patterns, 2012)

- Commuting patterns (10%): The percentage of employees age 16 and over in each MSA who don’t drive alone to get to work; this includes people who car pool, take public transit, walk, bicycle, take a taxi or use other means (American Community Survey, 2013)

- Commute time (5%): The average time in minutes that it takes employees age 16 and over in each MSA to get to work, regardless of the means they use to arrive (American Community Survey, 2013)

- Unemployment (10%): The unemployment rate for each MSA (Local Area Unemployment, Bureau of Labor Statistics, February 2015)

- Median earnings for tech workers (10%): The median salary for workers in the industry subsector Computer, Engineering and Science Occupations in each MSA (American Community Survey, 2013)

- Cost of living (10%): The section 2, 100% composite index for each city from the annual Cost of Living Index (Council for Community and Economic Research, 2014)

- Air quality (5%): The State of the Air report grades for ozone and 24-hour particle pollution for the county each city is located in (American Lung Association, 2014)

- Colleges (15%): The number of colleges, universities and professional schools per 100,000 residents in each MSA (U.S. Census Population Estimates, 2012; County Business Patterns, 2012)

- Entertainment (10%): The number of performing arts, spectator sports and related industries; restaurants; and bars per 100,000 residents in each MSA (U.S. Census Population Estimates, 2012; County Business Patterns, 2012)

- Venture capital investment (5%): The number of deals and total amount of venture capital invested in each MSA (National Venture Capital Association, 2014)

- State growth (10%): For all states except Michigan, the projected growth between 2012 and 2022 for all jobs within group 15-1100: Computer Occupations, as categorized by the Standard Occupational Classification system (Projections Central, 2014; For Michigan, the projected growth between 2010 and 2020 for all jobs within group 15-1100 (Michigan Department of Technology, Management & Budget, 2013)

A total of 114 cities met our minimum population requirements, but 36 were excluded for one of three reasons, leading to the final sample size of 78:

- The city was in a Metropolitan Statistical Area that was already covered in the study, and it was not the primary city in that metro area. (8 cities)

- The city was not included in the Cost of Living Index. (12 cities)

- The city was not included in the venture capital data set from the National Venture Capital Association. (16 cities)

Sources

“Washington area pops onto tech radar as alternative to Silicon Valley,” The Washington Post, January 20, 2014, http://www.washingtonpost.com/business/capitalbusiness/washington-area-pops-onto-tech-radar-as-alternative-to-silicon-valley/2014/01/20/b16003c4-6662-11e3-a0b9-249bbb34602c_story.html

“Why I turned down Silicon Valley for Washington, DC,” The Next Web, November 6, 2014, http://thenextweb.com/entrepreneur/2014/11/06/turned-silicon-valley-washington-dc/

“Metro companies set pace for growth,” Atlanta Business Chronicle, April 25, 2014, http://www.bizjournals.com/atlanta/print-edition/2014/04/25/metro-companies-set-pace-for-growth.html